The Pros and Cons of Investing in Common Metals

When people talk about metal investing, the conversation often turns to gold and silver. Yet copper, aluminum, nickel, zinc, and other common metals quietly support the backbone of the global economy. They don’t have the same glamour, but they power homes, cities, transport networks, and clean energy projects. For investors, these metals represent both opportunity and danger. They track industrial progress, offering growth potential, but they also mirror downturns with unforgiving precision. Understanding their pros and cons requires looking at demand, volatility, access, and how the future of industry may reshape their role in portfolios.

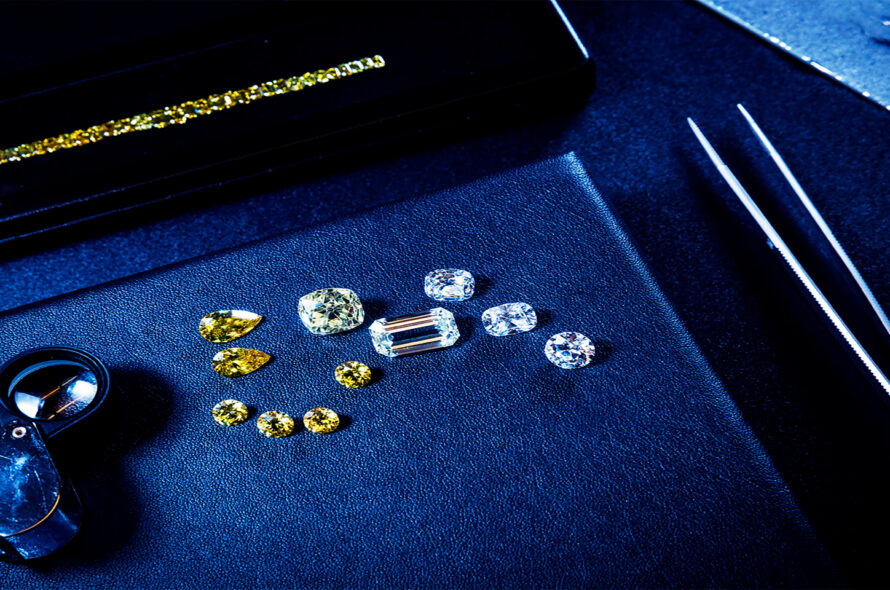

Industrial Demand as a Growth Driver

One of the biggest advantages of common metals is that their value is tied directly to real-world development. Copper is essential in wiring and power grids. Aluminum is prized for lightness in cars and aircraft. Nickel is central to stainless steel and batteries. Zinc protects steel from corrosion in construction. These uses are not optional; they are built into modern infrastructure and technology. Every time a city expands its metro, a company upgrades its factory, or a country builds wind turbines, demand for these metals increases. This makes them attractive because their prices reflect tangible economic activity rather than pure speculation.

Examples of Demand Surges

In the early 2000s, China’s rapid urbanization created a copper boom, pushing prices to record highs. More recently, electric vehicles have boosted nickel demand as manufacturers seek higher-capacity batteries. In developing nations, aluminum demand spikes when governments commit to transport upgrades, from rail cars to aircraft fleets. Each example shows how industrial cycles transform common metals into high-growth assets for short periods of time.

| Metal | Main Industrial Use | Current Demand Trend |

|---|---|---|

| Copper | Power grids, electronics | Strong, tied to electrification |

| Aluminum | Transport, packaging, construction | Steady, rising with lightweight transport |

| Nickel | Batteries, stainless steel | Rapid growth, linked to EV industry |

| Zinc | Galvanization, construction | Moderate, tied to urban expansion |

Price Volatility and Market Exposure

On the downside, common metals are highly volatile. Unlike gold, which tends to rise when markets panic, copper and aluminum usually fall during downturns. Their prices mirror economic health: when factories slow, demand collapses. This volatility makes them risky for investors who expect steady returns. For example, during the 2008 financial crisis, copper prices dropped more than 50% within months. The same pattern repeated during the early stages of the COVID-19 pandemic. Investors must be prepared for sharp swings, often dictated by events outside their control such as trade disputes or energy shortages.

Examples of Sharp Price Shifts

In 2019, U.S.-China trade tensions caused aluminum prices to fluctuate by more than 20% in a few months. In 2022, nickel prices spiked so suddenly—driven by fears of supply shortages from Russia—that exchanges had to suspend trading. These examples highlight that investing in common metals often means riding waves of volatility that even experts struggle to predict.

| Volatility Driver | Impact | Risk for Investors |

|---|---|---|

| Economic recessions | Demand crashes, prices plummet | High portfolio losses |

| Trade disputes | Tariffs and restrictions increase uncertainty | Unstable pricing |

| Mining disruptions | Labor strikes, political unrest, or accidents reduce supply | Sudden short-term price spikes |

| Energy inflation | Raises cost of mining and refining | Margins narrow, producers struggle |

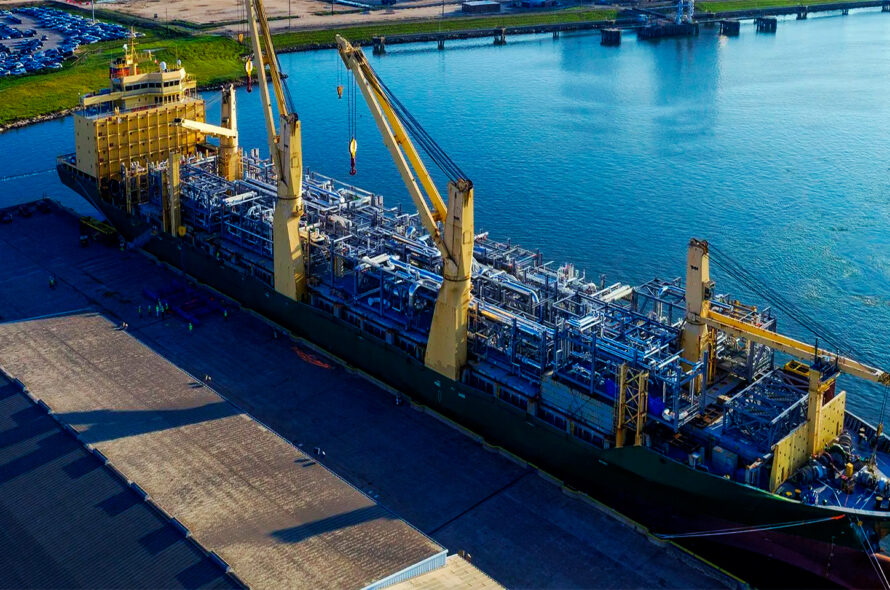

Storage and Accessibility Challenges

Another practical issue is storage. Precious metals like gold can be held in small bars or coins. Copper and aluminum, by contrast, are bulky. Owning them physically requires warehouses, security, and maintenance. That’s why most investors avoid direct ownership. Instead, they choose exchange-traded funds (ETFs), futures contracts, or shares in mining companies. These provide exposure without the hassle of physical storage but introduce their own risks, such as counterparty failures or management inefficiencies.

Examples of Access Routes

Investors looking for copper exposure often buy ETFs tracking its price rather than storing metal coils. Some choose shares of mining giants with global operations. Industrial buyers—like manufacturers—enter supply contracts with producers to secure steady flows. Each approach balances convenience with risk. The further investors move from physical metal, the more they depend on financial systems that may not always align perfectly with commodity prices.

Diversification Benefits and Drawbacks

Common metals offer diversification in a portfolio, but it is not the same type of safety that gold provides. Instead of acting as a safe haven, they act as growth-linked assets. When economies thrive, these metals rise, often outperforming traditional investments. But during downturns, they can drag portfolios lower. The diversification they provide is cyclical rather than defensive. For investors seeking exposure to infrastructure spending or renewable energy projects, common metals add valuable balance. For those looking for crisis protection, they can be disappointing.

| Benefit | Drawback |

|---|---|

| Exposure to industrial growth and green energy | Performance tied to economic cycles |

| Portfolio diversification | No safe-haven qualities |

| Potential high returns during booms | Steep losses during downturns |

Case Studies of Metal Investment Patterns

Looking at past cycles helps explain how metals behave. During the global infrastructure boom of the early 2000s, copper prices tripled within five years. Investors who held positions in futures or mining stocks saw significant gains. But the reversal was just as quick: after the 2008 crisis, copper lost half its value in months. Another example comes from nickel, which surged in the 2020s as battery production grew. Investors betting early on electric vehicles profited, while those entering late faced steep volatility. These case studies show both the potential and the pitfalls of investing in common metals—they reward timing but punish complacency.

Looking Ahead: The Green Energy Factor

Future demand for common metals will be increasingly shaped by renewable energy, electrification, and sustainability goals. Copper is expected to be one of the biggest beneficiaries as grids modernize and electric vehicle production accelerates. Nickel’s role in batteries makes it another growth candidate. Aluminum benefits from trends toward lightweight transport and packaging. These structural drivers suggest that metals tied to clean energy could maintain strong demand even through economic turbulence. Yet this raises new challenges: environmental costs of mining, geopolitical competition for resources, and recycling capacity may limit how sustainable growth really is.

A Mini-Scenario: Energy Transition Pressures

Picture a country announcing a ten-year plan to electrify its bus fleet and expand solar and wind capacity. At first, copper and nickel demand rises steadily. But as deadlines near, orders flood the market, creating shortages. Prices climb sharply, rewarding investors who bought early. Manufacturers, however, face squeezed margins as costs escalate. In response, the government launches recycling programs and pushes for alternatives. This scenario illustrates how metals can shift from steady growth to volatile spikes once demand outpaces supply.

A Second Scenario: Recycling Revolution

Now imagine a global shift where recycling technology becomes cheap and efficient. Instead of extracting new copper and aluminum, countries recycle old electronics, cars, and buildings at scale. This reduces demand for mined metals, easing prices. For investors, profits are less dramatic but more stable. The outcome shows how technological innovation may cool the boom-and-bust cycles of common metals while still offering steady, long-term returns.

Conclusion

Investing in common metals brings both opportunity and risk. On the positive side, they track real industrial growth, benefit from electrification, and offer diversification beyond stocks and bonds. On the negative side, they are volatile, tied to economic cycles, and often difficult to access directly. Case studies show how fortunes can be made or lost depending on timing. Looking ahead, green energy and recycling could reshape demand, creating both growth and disruption. For investors willing to accept the trade-offs, common metals offer exposure to the raw materials of progress—but they require caution, timing, and a clear view of the cycles ahead.