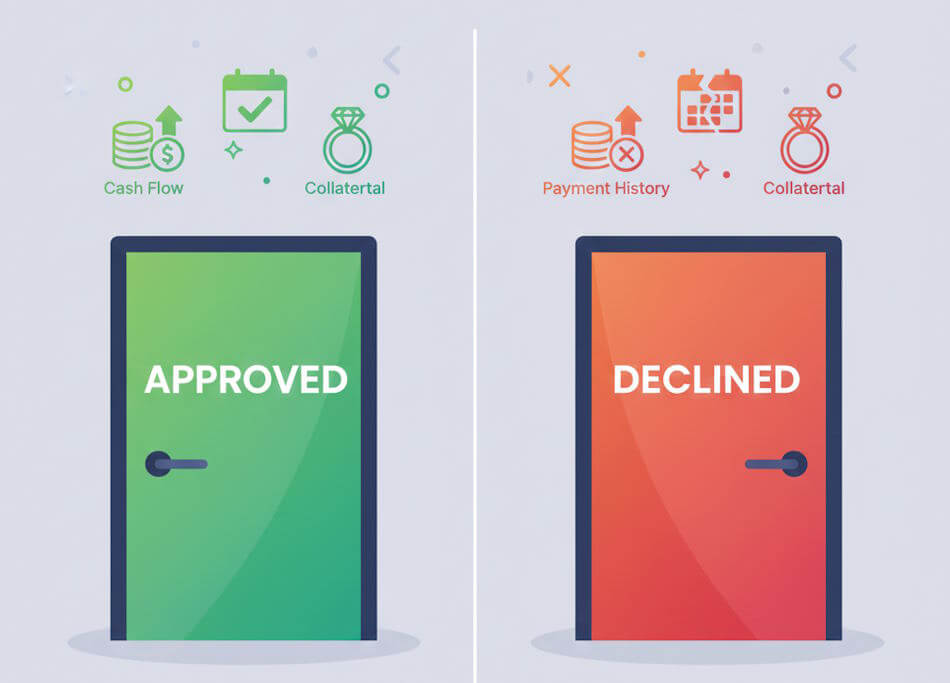

When a small business owner first hears the phrase “business credit rating,” it can feel abstract — like a mysterious number tucked somewhere behind the scenes that decides whether a loan is approved or declined. In reality, credit ratings are built from understandable building blocks. This post walks through the main factors lenders examine, why they matter, and practical steps you can take to improve your odds of getting the capital your business needs.

What exactly is a business credit rating?

A business credit rating (or score) is a numeric or letter-based summary of a company’s creditworthiness, assembled from payment history, financial statements, public records and other signals. Much like a personal credit score, it helps lenders estimate the risk of extending credit. But unlike a consumer score, business ratings also reflect company structure, industry risk and sometimes the owner’s personal credit if the business is small or recently formed.

If you’ve ever been surprised to see third-party collections or collection agencies listed on a business credit file, you’re not alone. For example, many business owners end up researching entries like BCG Equities LLC on credit reports to understand how these listings affect their ability to borrow. Seeing a collection entry is stressful — but it’s also fixable in many cases, and knowing how lenders treat such items helps you prioritize which problems to tackle first.

The top factors lenders examine

Different bureaus and lenders use slightly different models, but the most load-bearing factors are consistent: payment history, debt load, company financials, credit utilization, length and depth of trade relationships, public records (bankruptcies, liens), and industry or macro risk. Below is a compact table you can use as a quick checklist.

| Factor | What it measures | Why lenders care | How to improve |

|---|---|---|---|

| Payment history | Timeliness and consistency of past payments | Strong indicator of future behavior | Pay on or before terms; negotiate payment plans if delayed |

| Debt levels & coverage | Total liabilities vs. income/cash flow | Shows ability to service new debt | Reduce short-term debt; increase cash reserves |

| Financial statements | Revenue, profit margins, cash flow | Core evidence of business health | Keep accurate books; present clear forecasts |

| Credit utilization | Percentage of available credit used | High ratios increase perceived risk | Request higher limits, pay balances regularly |

| Public records | Bankruptcies, liens, tax judgments | Serious red flags for lenders | Address liens; settle or show repayment history |

How lenders combine quantitative and qualitative signals

Lenders rarely rely on a single score. They combine quantitative metrics (ratios, credit score, payment history) with qualitative assessments: the business plan, market position, management experience, and the reason for borrowing. For example, a short-term working capital line to capture a confirmed contract is viewed differently from a long-term loan aimed at restructuring existing debt.

Your narrative matters. Good bookkeeping and a clear explanation of how the funds will be used — plus supporting documents like contracts or purchase orders — can offset a middling score. That’s why it’s worth preparing a short lender-facing packet: balance sheet, profit & loss, cash flow projection, and a one-page executive summary describing the use of proceeds and repayment plan.

Small-business specifics: owner credit and business structure

Many lenders will ask for a personal guarantee or check the owner’s credit, especially for younger or smaller businesses. If your company has existed for only a couple of years or carries thin revenue, lenders often treat the owner’s personal financial footprint as a proxy for business stability. Incorporating, establishing a separate business bank account, and building trade lines in the business name are important steps to separate personal and business profiles over time.

Red flags that frequently lead to denials

Common reasons lenders say “no” include recurring late payments, cascading debts (high short-term obligations), unresolved tax liens, inconsistent cash flow, and a lack of collateral or credible repayment plan. Seasoned underwriters also look for soft signs: sloppy accounting, missing tax returns, or evasive answers during the application process. Honesty and organization drastically improve your chances — if you don’t have the numbers, say so and explain your plan to get them.

Practical steps to strengthen your application

- Audit your business credit file: request copies from major bureaus and correct errors promptly.

- Pay down high-cost short-term debt: it improves your debt-service ratios and signals discipline.

- Build trade references: reliable suppliers who report positive payment behavior are valuable.

- Prepare clean financials: lenders respond well to clear, consistent statements and realistic projections.

- Be transparent: explain past issues and show a credible plan — lenders prefer known risks to surprises.

Tip: If your business credit file shows a collection or a minor judgment, don’t assume it’s an automatic deal-breaker. Some lenders will consider a settled collection with supporting documentation. The key is to address it openly and provide recent evidence of improved payment behavior.

Final thought: credit ratings are important, but context wins

Business credit ratings are powerful tools that summarize past behavior, but they are not destiny. Lenders want to understand whether your business will reliably repay the loan. By improving the measurable elements (timely payments, lower utilization, clear financials) and crafting a persuasive, honest narrative that explains how borrowed capital will be used and repaid, you move from a passive score-holder to an active, trusted borrower.

Think of your credit rating as one page in a short story — it’s most persuasive when the other pages (financials, contracts, management credibility) are well written. Start by pulling your credit reports, cleaning up any errors, and building a lender packet that tells a coherent, realistic story. That combination will make lenders more comfortable saying “yes” when you need capital most.