How Regulators Control the Debt Load of Large Companies

When corporations borrow heavily, they don’t just put their own futures at risk—they can rattle entire markets. Regulators step in to make sure debt levels don’t spiral into crises. Their job is not to stop borrowing but to keep it within safe limits. The way they measure, enforce, and sometimes intervene shows how financial oversight works in practice. Watching regulators in action reveals the fine line between corporate freedom and systemic stability.

Why Oversight Exists

Regulators monitor corporate debt because the collapse of a single large borrower can trigger chain reactions. Think of airlines, energy giants, or telecom firms—businesses that carry billions in liabilities. If one falters, suppliers, banks, and workers feel the hit. Debt is necessary for growth, but unchecked debt can destabilize markets. Oversight ensures that companies borrowing on a massive scale disclose their risks clearly and face limits when leverage becomes unsustainable. By enforcing rules, regulators try to prevent sudden shocks like bankruptcies that spread far beyond the original borrower.

The Systemic Risk Factor

A heavily indebted corporation poses risks not only to itself but to creditors, employees, and entire sectors. Oversight reduces the likelihood of cascading failures.

Balancing Growth and Safety

Debt fuels expansion, but regulators aim to draw a line between healthy borrowing and dangerous overextension.

Tools Regulators Use

Oversight does not rely on one rulebook—it uses layers of tools. Agencies require companies to publish debt ratios, liquidity levels, and repayment schedules. Stress tests simulate crises, asking whether firms could survive sharp interest rate hikes or sudden revenue drops. Regulators also demand credit ratings from independent agencies, which serve as benchmarks for investors. In some industries, borrowing caps or capital adequacy requirements are enforced. These tools combine disclosure with pressure, shaping how companies approach financing decisions.

Mandatory Disclosures

Companies must reveal the scale of their borrowing, allowing markets and watchdogs to track leverage in real time.

Stress Testing

By running crisis scenarios, regulators measure resilience and expose hidden vulnerabilities in debt-heavy corporations.

| Regulatory Tool | Purpose | Effect on Companies |

|---|---|---|

| Disclosure rules | Transparency on debt structures | Forces accountability to investors |

| Stress tests | Simulate adverse events | Identifies weak debt positions |

| Borrowing caps | Limits maximum leverage | Prevents overextension |

Sector-Specific Supervision

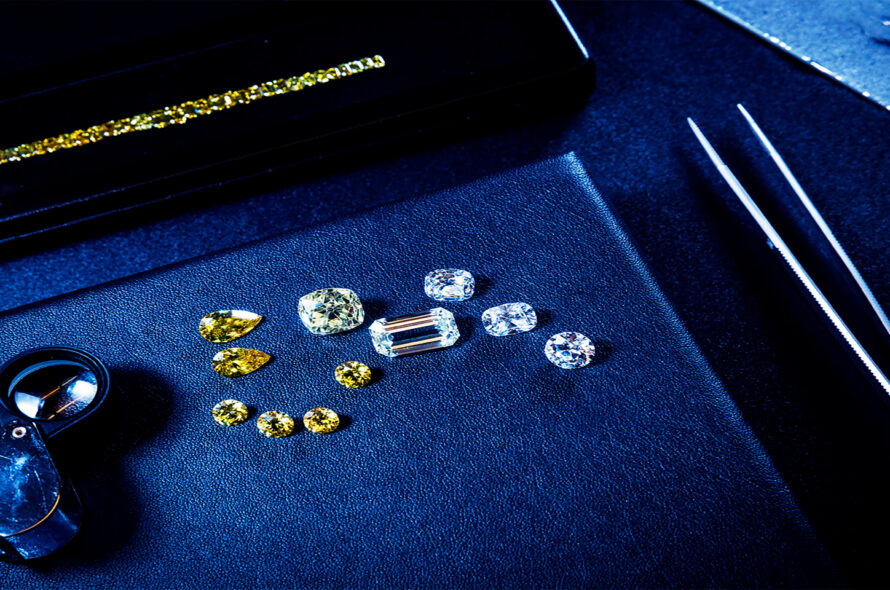

Not every industry carries the same risk profile, so regulators tailor oversight. Banks and insurers face some of the toughest debt restrictions, since their failures can destabilize entire economies. Utilities and telecom firms, due to their public importance, are also closely monitored. Manufacturing or retail may see lighter rules, though listed corporations must still meet transparency requirements. The principle remains the same: the bigger the systemic risk, the heavier the oversight. By scaling control, regulators focus resources where the fallout of excess debt would be hardest to contain.

Financial Institutions

These firms operate at the core of markets, so regulators impose strict capital requirements to limit debt exposure.

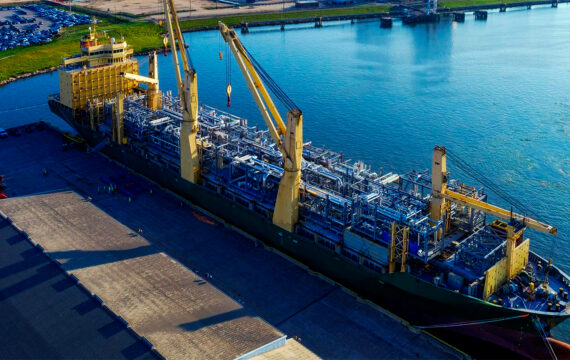

Strategic Industries

Energy, utilities, and telecoms often face borrowing restrictions because their collapse would impact millions of households.

Enforcement and Interventions

When companies cross safe thresholds, regulators don’t just watch—they act. They can demand repayment plans, block mergers that rely on excessive debt, or require divestments to reduce leverage. In extreme cases, governments step in with bailouts tied to stricter conditions. Enforcement ensures that warnings are backed by consequences. The power to intervene acts as a deterrent, pushing corporations to self-regulate before watchdogs step in. Intervention is not about punishing debt but ensuring that excess borrowing does not become a time bomb for markets.

Direct Orders

Regulators can require companies to reduce leverage, sell assets, or halt new borrowing until balance sheets stabilize.

Market Deterrence

Public scrutiny and rating downgrades amplify enforcement, making borrowing costlier and encouraging discipline.

| Intervention Type | How It Works | Example Result |

|---|---|---|

| Repayment plans | Mandated debt restructuring | Gradual deleveraging |

| Merger restrictions | Debt-heavy acquisitions blocked | Reduced systemic exposure |

| Government-backed bailout | Emergency support with conditions | Stabilization at the cost of control |

Global Differences in Oversight

Debt regulation varies worldwide. In the U.S., corporate disclosure is strict, but intervention is often reactive. In Europe, regulators are more likely to cap borrowing early, especially for large multinationals. Emerging markets rely heavily on international lenders and may face oversight through loan conditions from global institutions. These differences mean that the same corporation can face looser or tighter restrictions depending on where it operates. As companies go global, they must navigate this patchwork of debt regulation, tailoring strategies for each jurisdiction to remain compliant.

Western Models

U.S. and European regulators differ in timing: one favors transparency first, the other emphasizes pre-emptive control.

Emerging Markets

Oversight often comes through conditions on international loans, limiting how much firms can borrow domestically.

What Oversight Achieves

Controlling corporate debt is less about stopping growth and more about ensuring stability. When regulators impose rules, they aim to protect workers, investors, and national economies from fallout. Oversight promotes trust in markets: lenders know that corporate debt cannot spiral unchecked, and investors gain clearer insight into risks. Though companies may complain about restrictions, the long-term benefit is smoother growth and fewer crises. Regulation ensures that debt remains a tool for progress rather than a source of collapse.

Market Stability

Clear rules reduce uncertainty, keeping credit markets functional even in downturns.

Investor Protection

Oversight ensures fair disclosure, giving investors a realistic picture of risk before committing funds.

Looking Ahead: The Future of Debt Oversight

The way regulators monitor debt is changing. Artificial intelligence and big data are making it possible to track borrowing in real time. Instead of waiting for quarterly reports, regulators may soon see company debt positions updated daily, spotting red flags earlier. Digital reporting standards are spreading globally, automating disclosures and reducing gaps in information. At the same time, sustainable finance pressures could reshape oversight—loans tied to environmental or social impact may receive favorable treatment, while debt used for riskier practices could be penalized. The future points toward oversight that is faster, more predictive, and more integrated with broader goals like climate resilience and corporate responsibility.

AI and Predictive Analytics

Regulators are testing machine learning systems to detect early signs of overleveraging, catching problems before they trigger crises.

Digital Transparency

Automated disclosures through digital platforms will make hidden debt harder to conceal and strengthen investor confidence.

Conclusion

Large corporations will always borrow—it’s part of scaling and competing. But without oversight, debt can grow into a danger for whole economies. Regulators enforce disclosures, stress tests, and borrowing limits to keep risks in check. They intervene when needed, shaping not just individual firms but entire markets. By balancing corporate freedom with financial stability, regulators make sure that debt fuels growth instead of disaster. Watching how these mechanisms evolve shows where the next fault lines in global finance may appear.