NFT Jewellery and Lending for New Forms of Art

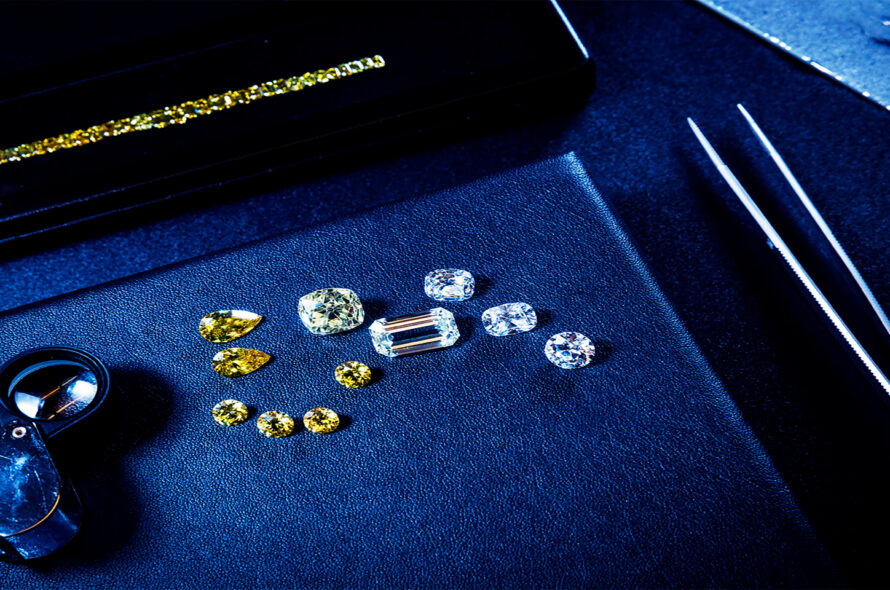

The worlds of jewellery and digital art are colliding in unexpected ways. Tokenised diamonds, blockchain-backed certificates, and NFT jewellery pieces are entering auctions and private sales. Alongside them comes a new set of financing questions: how do you borrow against digital assets, and how do credit products adapt when the collateral is not a physical stone but a token on the blockchain? Lenders, collectors, and artists are experimenting with new credit tools designed for an economy where value exists both in vaults and in virtual wallets.

Why NFT Jewellery Is Different

Traditional jewellery is tangible: it can be weighed, stored, insured, and displayed. NFT jewellery is digital-first, with blockchain tokens representing ownership of designs, 3D renderings, or even hybrid physical-digital pieces. The challenge for lenders is that value depends on digital scarcity and market demand rather than intrinsic material worth. While a gold necklace can always be melted and sold, an NFT pendant’s price depends on whether a buyer values its uniqueness. This makes lending riskier, but it also opens up new possibilities for credit innovation tailored to fast-moving digital markets.

| Feature | Physical Jewellery | NFT Jewellery |

|---|---|---|

| Collateral value | Based on materials and craftsmanship | Based on digital scarcity and demand |

| Storage | Physical vaults, insurance | Blockchain wallets, security keys |

| Resale options | Pawnshops, auctions, retail | NFT marketplaces, peer-to-peer sales |

Credit Products for Tokenised Assets

Specialised credit products are emerging for tokenised stones and NFT art. Some fintech platforms already allow collectors to pledge NFTs as collateral in exchange for short-term loans. Others bundle NFTs with physical assets, offering hybrid loans secured by both a real diamond and its tokenised certificate. This blending of old and new reduces risk for lenders while keeping digital-native buyers engaged. The flexibility of blockchain also allows for fractional ownership, meaning groups of investors can co-finance jewellery pieces and unlock credit against their shared tokens. These experiments are shaping the next generation of art and jewellery lending.

| Credit Mechanism | How It Works | Main Advantage |

|---|---|---|

| NFT-backed loans | Borrower pledges NFT as collateral | Fast access to liquidity |

| Hybrid loans | Collateral includes both token and physical stone | Reduces default risk |

| Fractional lending | Multiple owners use token shares as collateral | Broadens participation |

The Role of Auction Houses

Major auction houses are beginning to experiment with NFT jewellery sales. These events attract both crypto investors and traditional jewellery collectors. Credit plays a big role here: bidders use digital lending platforms to finance purchases, while sellers often rely on credit lines secured by future sales. Some houses even collaborate with fintech lenders to offer on-the-spot financing for NFT purchases, creating a seamless blend of bidding and borrowing. This hybrid world blurs the lines between traditional auction credit and decentralised finance, setting the stage for an entirely new category of lending in the art market. If demand continues to grow, auction houses could become testing grounds for innovative lending models that later spread across other sectors of the art world.

Challenges Facing Lenders

Lending against NFT jewellery comes with unique risks. Volatility is higher than in physical jewellery markets, and pricing can swing dramatically within weeks. Questions of authenticity also arise: while blockchain verifies ownership, the long-term value of digital designs remains untested. Regulatory frameworks are still catching up, leaving lenders exposed to legal uncertainty. To manage these risks, some lenders cap loan-to-value ratios, while others require hybrid collateral structures. Insurance products for digital assets are also emerging, but adoption remains slow. Until these challenges are resolved, credit in this sector will remain experimental rather than mainstream.

Looking Ahead

The future of NFT jewellery lending depends on whether digital assets become established alongside traditional stores of value. If NFT jewellery gains recognition as a lasting art form, financing structures will mature, interest rates will stabilise, and mainstream banks may eventually enter the space. On the other hand, if demand remains speculative, lending will stay limited to fintech platforms and private arrangements. Either way, the dialogue between blockchain technology, jewellery design, and credit markets has already reshaped how we think about value. For investors, collectors, and creators, this convergence represents both risk and opportunity.

Mainstream adoption

In a future where NFT jewellery gains wide acceptance, banks will likely create dedicated lending products. Hybrid collateral models will become common, pairing NFTs with physical stones to reduce risk. Insurance companies will develop robust policies for digital assets, making it easier to secure loans. Auction houses could standardise NFT jewellery sales, with financing packages offered at the same time as bidding. In this scenario, NFT jewellery becomes a recognized part of wealth portfolios, making credit as accessible as it is for traditional jewellery.

Niche survival

If NFT jewellery remains confined to niche communities, lending will stay experimental. Decentralised platforms will dominate, offering peer-to-peer loans with higher interest to offset risks. Loan terms will be inconsistent, and only a small group of collectors will participate actively. Market volatility will continue to deter mainstream banks. NFT jewellery will survive as a creative form of expression but will not achieve the liquidity necessary to attract widespread credit support. This path would limit growth but preserve exclusivity, making NFT jewellery a specialized but enduring corner of digital art.

Hybrid evolution

A more likely outcome is somewhere in between. NFT jewellery may not replace traditional stones but will complement them. Physical-digital hybrids, where each jewel comes with a tokenised twin, could become standard. Credit systems will evolve to handle both sides at once, offering balanced lending packages. This hybrid model reduces risk while capturing new markets. It appeals to traditional buyers who want tangible value and digital-native investors who value blockchain uniqueness. Over time, this approach could redefine how jewellery is financed, traded, and collected worldwide.

Conclusion

Credit mechanisms for NFT jewellery and tokenised stones are still developing, but they highlight how finance adapts to new forms of art. Loans backed by digital assets, hybrid collateral models, and fractional lending schemes are early experiments in a sector where value is as much about blockchain code as it is about carats and cuts. Scenario planning shows that NFT jewellery could become mainstream, remain niche, or evolve into a hybrid model. While risks remain high, the potential is equally strong: lending could become the bridge that makes NFT jewellery not just a curiosity but a sustainable part of global art and jewellery markets. For now, success will depend on balancing innovation with caution as digital and physical worlds continue to converge.