Borrowed Funds and Reconstruction of Destroyed Infrastructure

When bridges collapse, ports are damaged, or power grids are destroyed, the question is not whether to rebuild but how to pay for it. Few governments or companies keep enough reserves to cover large-scale reconstruction on their own. Borrowed funds fill this gap, acting as the financial backbone of recovery. Loans, bonds, and credit programs allow reconstruction projects to begin immediately instead of waiting for years of accumulated savings. They also stabilize economies by creating jobs, restoring essential services, and keeping supply chains alive. In practice, credit becomes the invisible scaffold behind every visible rebuild.

The Financial Reality of Rebuilding

Reconstruction projects are capital intensive. A single damaged highway can cost billions to repair, while restoring an airport or energy system requires even more. For states and corporations, paying upfront is nearly impossible without draining budgets or halting other services. Borrowed funds spread these costs over decades, making urgent rebuilding manageable. The ability to borrow determines not only how fast projects start but also how broadly economies recover. Without loans, reconstruction lags and affected regions risk long-term stagnation. With credit, the process accelerates, and recovery generates growth far beyond the initial project itself.

Why Immediate Liquidity Matters

Funds made available through borrowing allow reconstruction to begin without delay. Waiting for tax collection or budget reallocation slows recovery, while loans unlock projects instantly.

Balancing Long-Term Repayment

By spreading repayments across decades, governments and corporations prevent short-term crises from draining all resources, ensuring stability during rebuilding.

| Infrastructure Type | Average Reconstruction Cost | Typical Financing Method |

|---|---|---|

| Highways and bridges | Hundreds of millions to billions | Government bonds and syndicated loans |

| Power grids and utilities | Billions | Multilateral development loans |

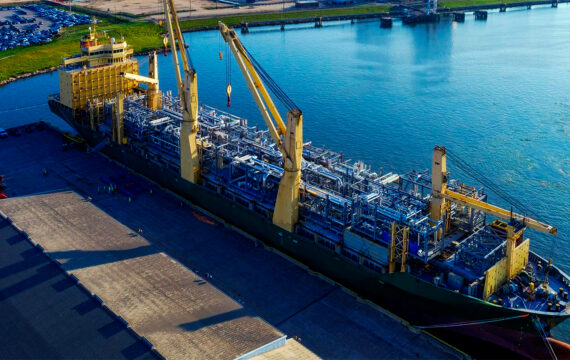

| Airports and ports | Billions | Public-private partnerships with credit support |

Why Borrowed Funds Are Essential

Credit is not just a way to cover costs—it creates momentum. When governments secure loans from international institutions, contractors, suppliers, and workers are paid quickly, which stabilizes communities after crises. Borrowed funds also attract private capital: investors are more likely to finance smaller projects when they see major works already underway. This combination of public loans and private participation speeds up reconstruction. Importantly, borrowing ensures that rebuilding is not piecemeal but systemic, restoring transport, energy, and communication networks together rather than in fragments. Without such systemic support, countries risk years of partial or uneven recovery, limiting growth and social stability.

Kickstarting Employment

Borrowed funds keep workers employed and generate income within local economies, creating demand that fuels broader recovery.

Restoring Confidence

When major rebuilding begins quickly thanks to credit, investor and citizen confidence improves, encouraging additional private and public contributions.

| Role of Borrowed Funds | Impact on Reconstruction |

|---|---|

| Immediate liquidity | Projects start without waiting for tax revenues |

| Job creation | Workers paid during rebuilding, boosting local demand |

| Investor confidence | Private capital follows government or multilateral loans |

Different Models of Financing

Borrowing for reconstruction takes many forms. Some states issue long-term bonds, distributing repayment across generations. Others use international loans from institutions such as development banks, often with concessional interest rates to ease the burden. In some cases, public-private partnerships emerge, where corporations co-finance infrastructure in exchange for operational rights. Each model reflects the scale of destruction and the political willingness to manage debt. What unites them is the principle that borrowing allows rebuilding now rather than later, reducing the economic and social costs of delay. The choice of model often determines not just the pace but also the scope of recovery.

Bonds and Securities

Governments issue long-term bonds to raise immediate funds while spreading repayment responsibilities across decades.

International Development Loans

Development banks provide concessional loans that reduce financial pressure and bring technical oversight to ensure efficiency.

The Economic Ripple Effects

Borrowed funds for reconstruction are not just about fixing what is broken. They stimulate broader economic recovery. Rebuilding roads reopens trade routes, ports restore exports, and energy systems attract industries back to affected regions. Employment surges as construction begins, while local suppliers benefit from new contracts. The multiplier effect ensures that each borrowed dollar produces more than just a bridge or power station—it produces growth. This is why borrowing is often considered an investment rather than a liability in post-crisis contexts. Strong credit-backed rebuilding transforms damaged areas into more competitive regions with long-term benefits.

Reviving Trade Routes

Reconstructed infrastructure reconnects regions, allowing exports and imports to resume quickly, sustaining business growth.

Strengthening Local Economies

Small businesses and local suppliers benefit directly when contracts are financed through borrowed funds, stimulating community-level recovery.

Country-Style Illustrations

One country faced severe flooding that destroyed highways and bridges linking rural regions to major cities. By issuing government-backed bonds and securing concessional loans from international lenders, it managed to rebuild quickly. Within three years, trade routes reopened, agricultural exports recovered, and employment in construction stabilized entire communities. Borrowed funds not only financed reconstruction but also catalyzed broader economic renewal.

In contrast, another country hit by earthquakes relied heavily on short-term commercial loans without strong oversight. Corruption and mismanagement delayed projects, and rising interest rates made repayment unsustainable. Instead of recovery, debt burdens grew while damaged infrastructure lingered. The difference between the two cases highlights how the type of borrowing and governance structures around loans often determine whether credit leads to resilience or deeper crises.

Positive Outcomes

Well-managed loans paired with transparent oversight can turn disaster into an opportunity for modernization and long-term growth.

Negative Outcomes

Poor management and risky borrowing terms can transform loans into obstacles, worsening debt crises rather than fostering recovery.

Risks and Constraints

Reliance on credit comes with risks. Heavy borrowing can burden future budgets, especially if interest rates rise. In fragile economies, debt servicing may compete with spending on healthcare or education. Corruption and mismanagement can also reduce the efficiency of borrowed funds, leaving projects incomplete or poorly executed. Transparency, strict oversight, and international support mechanisms are therefore essential to ensure loans translate into tangible recovery. Balancing urgency with fiscal discipline is the core challenge of financing reconstruction, and countries that fail to manage this balance risk trading immediate recovery for long-term instability.

Debt Burdens

Excessive reliance on borrowing creates repayment challenges that may crowd out social spending in the future.

Governance Challenges

Weak oversight can undermine the benefits of loans, leading to stalled or poorly executed reconstruction projects.

Looking at Future Reconstruction Finance

The future of borrowing for reconstruction will likely integrate digital monitoring tools, sustainability conditions, and innovative financing like green bonds. Development banks are already testing credit tied to climate resilience, ensuring that rebuilt infrastructure can withstand future shocks. Private investors are also entering the space through blended finance, where risks are shared with public lenders. These approaches will redefine how credit fuels reconstruction, making it faster, more resilient, and more globally coordinated. Borrowed funds will remain indispensable, but the way they are deployed is evolving to meet both immediate needs and long-term resilience goals.

Climate Resilience

New credit programs are linking loans to projects designed to withstand climate-related risks, reducing future vulnerabilities.

Blended Finance

By sharing risks between public and private lenders, blended models attract investment that multiplies the impact of borrowed funds.

Conclusion

Reconstruction after destruction is impossible without borrowing. Credit provides the means to act quickly, stabilize communities, and rebuild infrastructure on a scale that savings alone cannot cover. Whether through government bonds, development loans, or partnerships, borrowed funds shape the pace and scope of recovery. They carry risks, but they also create opportunities for long-term growth and modernization. In every collapsed bridge or shattered grid that rises again, credit stands behind the scenes as the foundation of recovery and resilience.