How Transnational Corporations Use Loans to Replace Suppliers

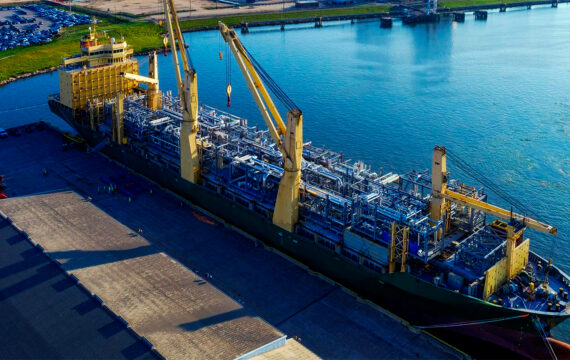

Global corporations thrive on complex supply networks. Yet when a supplier fails—whether from bankruptcy, sanctions, or natural disaster—entire production lines can freeze. What keeps multinationals moving is not only their scale but also their access to credit. Loans give these companies the flexibility to shift quickly, finance transitions, and secure new partnerships. Behind every headline about disrupted supply chains, there is often a story of borrowing to adapt and survive.

Why Supplier Failure Is So Costly

For transnational corporations, suppliers are rarely easy to replace. They often deliver unique parts, specialized raw materials, or proprietary components that cannot be sourced from just anywhere. When one of these suppliers fails, disruptions ripple across continents, halting production lines and shaking consumer confidence. Lost days turn into lost contracts, and penalties or reputational damage can quickly follow. In this high-pressure environment, waiting for internal cash flow to cover replacement costs is rarely feasible. Loans step in as the critical enabler, providing liquidity to absorb unexpected expenses, pay new suppliers in advance, and keep production alive until stability returns. Without access to credit, even the most established companies could face crippling setbacks.

The Domino Effect on Production

Supplier collapse does not stop at a single missed shipment. It disrupts entire production schedules, creating cascading delays. One absent component can ground entire factories, magnifying losses. Credit cushions this domino effect by financing emergency solutions before the situation spreads further.

The Reputation Risk

Delays caused by supplier failures also weaken trust. Investors, customers, and governments expect global corporations to deliver regardless of disruption. Loans make rapid response possible, helping corporations prove reliability in turbulent times.

Loans as a Tool for Fast Adaptation

Replacing a supplier involves sudden costs—new contracts, higher prices, deposits, and even retooling production lines. Loans give corporations the ability to act decisively instead of stalling. A multinational automaker facing a semiconductor shortage can borrow to secure new deals in alternative markets. A global food producer disrupted by agricultural shocks may finance emergency imports to keep shelves stocked. Credit accelerates the decision-making cycle, letting multinationals adapt in days rather than months. The speed of borrowing is a competitive advantage that allows companies to keep market share when rivals hesitate.

Funding Emergency Procurement

Loans can be used to cover urgent purchases at premium prices. While costly, these moves are often the only way to sustain production and avoid deeper financial losses.

Maintaining Workforce Stability

Without quick financing, layoffs often follow supply shocks. Loans provide the working capital to keep staff employed during the transition, preventing long-term productivity damage.

How Multinationals Structure Their Borrowing

Global corporations rarely depend on a single loan. They design layered financing models to cover both immediate and long-term risks. Short-term credit lines fund urgent supplier changes. Syndicated loans from multiple banks finance larger adjustments like shifting supply bases across continents. Government-backed facilities sometimes support strategic industries such as defense or pharmaceuticals. By diversifying borrowing sources, corporations reduce vulnerability to sudden financial tightening. This flexible architecture is as important as the loans themselves, ensuring that when disruptions strike, companies have more than one lifeline to rely on.

Short-Term Credit Lines

These are activated when disruptions demand quick solutions, often funding deposits or emergency shipments.

Syndicated and Long-Term Loans

Used when supply chains need rebuilding at scale, syndicated loans bring multiple lenders together to share risks and costs.

Examples Across Industries

The use of loans to replace suppliers is not limited to one field. Technology firms borrow to secure rare materials when old supply contracts collapse. Pharmaceutical corporations rely on loans to navigate regulatory hurdles when shifting to new chemical providers. Consumer goods companies borrow heavily during seasonal disruptions, bridging the gap until stable flows resume. Even energy corporations finance sudden transitions to new raw material suppliers when geopolitical events cut off traditional routes. The unifying pattern is clear: across industries, loans are not just financial instruments—they are strategic responses that allow multinationals to preserve operations and customer confidence.

Technology Sector

When rare earth suppliers fail, technology firms use loans to build new partnerships in alternate regions, absorbing costs to avoid losing innovation cycles.

Pharmaceutical Industry

Loans cover legal compliance, quality testing, and contractual renegotiations when medical supply chains must pivot quickly.

Risks of Financing Supplier Replacement

While loans provide flexibility, they also create financial vulnerabilities. Rising global interest rates increase repayment costs, while misjudged supplier transitions can double expenses if a new partner also fails. Shareholders often scrutinize debt levels, and overreliance on loans for operational resilience can erode confidence in long-term stability. Companies mitigate these risks by splitting contracts among multiple suppliers, using hedging strategies to offset currency swings, and maintaining strong relationships with lenders. Even so, the balance remains delicate: credit keeps operations alive but can weigh heavily on balance sheets if overused or mismanaged.

Debt Load Concerns

Taking on too many loans at once can weaken financial health, making corporations vulnerable during wider market downturns.

Investor Confidence

Heavy dependence on credit can alarm investors, who may see it as a sign of fragility rather than resilience.

Changing Nature of Global Competitiveness

Competitiveness is no longer judged solely on efficiency or scale—it is judged on resilience. Corporations able to replace suppliers swiftly thanks to credit have an edge over rivals that hesitate. Access to loans has become part of global strategy, shaping who thrives when disruptions strike. Financial flexibility is as valuable as logistical strength, allowing corporations to prove reliability to clients and governments. Those with diversified funding sources and strong banking ties are best positioned to maintain competitiveness in a volatile global economy.

Resilience as Strategy

Credit ensures that companies are not derailed by a single supplier failure, strengthening their global standing.

Global Reputation

Corporations that adapt quickly through credit gain trust from customers and investors, reinforcing long-term competitiveness.

Looking Ahead: The Future of Borrowing for Supply Chains

The way corporations borrow to replace suppliers will evolve with financial technology. Digital lending platforms are reducing approval times from weeks to hours, a shift that will matter in sudden crises. Alternative lenders, including private equity and fintech firms, are already stepping in where banks hesitate. Blockchain contracts may tie loans directly to supply chain events, releasing funds when disruptions are verified. Governments may add conditional support, encouraging corporations to borrow in ways that build sustainable or resilient networks. This shows a future where borrowing is not only faster but also deeply embedded in how companies manage their global operations.

Technology-Driven Credit

Fintech and blockchain tools will accelerate credit decisions and make loan conditions more transparent, ensuring funds are tied directly to operational needs.

Policy-Linked Lending

Governments may incentivize borrowing for sustainable supply practices, reshaping how credit interacts with corporate responsibility.

Stress Point: Tight Credit Meets Supply Crises

A major vulnerability lies in the convergence of crises and tightening global credit cycles. If supply chains fail while borrowing costs rise, even well-prepared corporations may be forced to slow production. Those with diversified financing channels will survive, while others risk being pushed out of competitive markets.

Conclusion

Transnational corporations face constant tests to their supply chains. Disruptions arrive without warning, but the ability to borrow provides the cushion to adapt. Loans finance supplier replacements, cover costly transitions, and protect market share. They redefine competitiveness, making financial flexibility a strategic asset. As digital lending grows and global credit cycles fluctuate, the connection between borrowing and operational resilience will only deepen. Companies that master this balance will emerge stronger, while those without credit lifelines risk falling behind in the race for global stability.