Loans and Disruptions in the Supply of Military Equipment

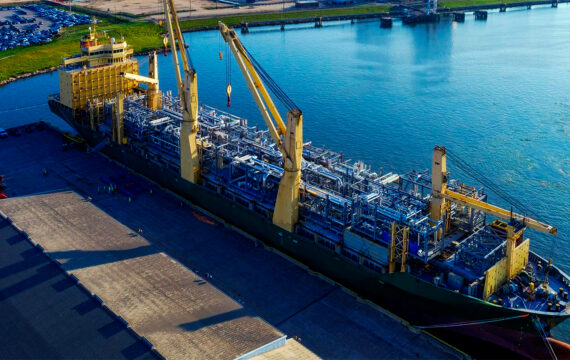

Supplying military equipment has always been complex. Delays, shortages of critical parts, and sudden changes in international regulations make it even more difficult today. Behind every contract lies a network of manufacturers, logistics providers, and governments. When that chain breaks, financing becomes the hidden lifeline. Loans step in to stabilize projects, cover unexpected costs, and ensure that procurement continues despite setbacks. The defense sector, more than most industries, shows how credit is not just about borrowing—it is about survival during disruption.

The Nature of Disruptions

Disruptions in defense supply chains can be caused by sanctions, political instability, labor strikes, or shortages of advanced components like semiconductors. Unlike civilian markets, where delays may inconvenience consumers, interruptions in military supply chains can undermine national security. Manufacturers cannot simply walk away from commitments, yet they often face immediate cost pressures when supply routes fail. Loans provide a buffer, allowing companies to continue production and absorb delays while renegotiating delivery schedules. In many cases, financing determines whether a project stalls indefinitely or pushes forward under pressure.

Why Financing Becomes Critical

Military contracts are high-value and long-term. They require upfront investment in materials, skilled labor, and specialized facilities. If delivery is disrupted, payments from governments or defense clients may also be delayed, leaving suppliers exposed. Loans fill this gap by offering working capital during downtime. Credit also funds the search for alternative suppliers, emergency transport, or higher-cost raw materials when traditional supply lines collapse. Without financing, even established defense firms can struggle to meet obligations, making loans an integral part of managing uncertainty.

| Disruption Type | Impact on Suppliers | Role of Loans |

|---|---|---|

| Sanctions | Loss of traditional suppliers | Funds sourcing from new markets |

| Logistics delays | Higher storage and transport costs | Provides liquidity to cover added expenses |

| Component shortages | Production halts | Finances R&D or alternative designs |

Government and Bank Involvement

Banks often hesitate to lend directly to defense suppliers due to high risks and regulatory complexity. This is where government-backed programs and export credit agencies intervene. By offering guarantees, they encourage banks to extend credit. Governments may also provide emergency financing themselves to ensure continuity in strategic procurement. These partnerships reduce default risk and make lending possible even in fragile circumstances. For suppliers, the availability of such financing is a signal that disruptions will not completely derail operations.

| Financing Source | How It Supports Defense Projects |

|---|---|

| Commercial banks | Working capital and short-term loans |

| Export credit agencies | Guarantees for international deals |

| Government programs | Emergency loans to protect procurement |

Case-Style Scenarios

Logistics breakdown

A defense supplier contracted to deliver vehicles faces a sudden strike at a major port. Containers are stuck for weeks, increasing storage costs. Loans allow the company to pay workers and cover transport penalties until shipments resume. The financing does not solve the disruption but prevents a financial collapse during the delay.

Sanctions and supplier shifts

A manufacturer sourcing specialized electronics loses access to a key foreign supplier due to new sanctions. The company must quickly find replacements in a different market, often at higher costs. Loans finance this transition, funding both the search and the purchase of pricier substitutes. Without credit, the project would risk cancellation.

Component shortages

Aerospace firms face global shortages of high-grade alloys. Production slows, threatening delivery timelines. Loans fund temporary R&D to test alternative materials and cover rising costs from smaller suppliers. Financing helps the firm meet deadlines, even if margins shrink, and preserves its long-term government relationship.

Emerging Paths for the Next Decade

The defense industry is already experimenting with new ways to integrate finance and supply management. One path is digital monitoring of supply chains, where real-time data allows lenders to adjust credit conditions as risks shift. If a component shipment is delayed, banks might extend repayment schedules automatically. Another development is the potential use of blockchain-backed documentation, making collateral and contracts more transparent and harder to dispute. Beyond technology, governments may begin linking loan conditions to sustainability or ethical sourcing, reflecting broader shifts in finance. These paths suggest that loans will not remain static—they will adapt alongside the challenges and values that shape global defense procurement.

Speculative Outlook: How It Could Work

Imagine a future in which lenders connect directly to defense suppliers’ digital supply chain systems. If a shipment of critical parts is flagged as delayed, the bank’s system automatically unlocks additional liquidity, allowing the supplier to pay for emergency air freight. Once the goods arrive, repayment terms are adjusted dynamically to reflect the higher transport costs. In another case, blockchain contracts could automatically trigger government-backed guarantees if sanctions freeze a supplier, ensuring that banks receive repayment while manufacturers secure alternative sourcing. These speculative examples show how finance may not only react to disruptions but become integrated into the operational fabric of defense procurement, creating a system where loans adjust as fast as crises unfold.

Geopolitical Dimensions of Future Lending

Global rivalries will play an increasing role in shaping defense lending. Credit lines may not just reflect financial risk but also political alignment. Suppliers working within one geopolitical bloc could receive favorable loan terms, while those dealing with rival nations might face restricted access or higher costs. For example, a bank operating under one alliance may prioritize financing defense equipment projects that strengthen its bloc’s supply chain while cutting back on credit for companies exposed to competitors. This dynamic will fragment defense lending into regional networks, where access to finance becomes as strategic as access to raw materials. In such an environment, loans are not neutral—they are tools of influence, shaping which projects move forward and which stall under financial pressure.

Interest Rate Cycles and Amplified Risks

Another layer shaping future lending will be global interest rate cycles. In periods of low interest rates, governments and defense suppliers will borrow more aggressively to finance projects, creating momentum in procurement even during disruptions. But when central banks tighten policy, borrowing costs rise, and lenders become more selective. This shift could amplify geopolitical divides: wealthier blocs may still afford credit for their defense industries, while smaller or less stable countries may see loans dry up. In effect, interest rate cycles will not only affect affordability but also tilt the balance of military readiness. A tightening cycle may expose weaker economies to greater vulnerabilities, while looser cycles may accelerate procurement races among major powers. The swings of global finance will therefore echo directly into defense supply chains, magnifying both opportunity and risk.

Conclusion

When supply chains in defense industries fail, the consequences reach beyond business—they touch national security. Loans are the hidden force that allows projects to keep moving when sanctions, shortages, or delays disrupt normal operations. Banks, governments, and export agencies together create a financing ecosystem that supports continuity and stabilizes procurement. With emerging tools, speculative models, geopolitical rivalry, and shifting interest rate cycles shaping conditions, the role of loans will become even more central in the coming decade. In a world of rising geopolitical risks, financing is not just an accessory—it is a foundation for the resilience of military supply chains.